Introduction

Thinking about how to sell car with financed loan in Rancho Cucamonga? Perhaps you’re dreaming of that new truck to tackle the local terrain, or maybe you’re downsizing now that the kids have flown the coop. It’s a common scenario: you want to sell your car, but you’re still making payments on it.

The good news is that selling a car with an outstanding loan is a perfectly manageable process. While it might seem daunting at first, many residents in Rancho Cucamonga navigate this situation successfully every day. Don’t worry; you’re not alone, and it’s absolutely achievable.

This guide will break down the options available to you, providing step-by-step instructions and highlighting important legal considerations specific to selling a financed vehicle in our community. Whether you’re driving a popular SUV or a fuel-efficient sedan, understanding the process will empower you to make informed decisions and get the best possible outcome when selling your car in Rancho Cucamonga.

Understanding Your Loan

Before you even think about putting that “For Sale” sign in the window, becoming intimately familiar with your car loan is absolutely paramount. You can’t effectively plan how to sell car with financed loan if you don’t know the exact landscape of your financial obligation. It’s like trying to navigate the 210 freeway during rush hour without knowing where you’re going – you’re bound to end up in a frustrating situation.

The first and most critical piece of information is your current loan balance. Don’t rely on your memory or a vague estimate. Get the exact figure. Fortunately, this information is usually readily accessible. Here’s how to find it:

Beyond the principal balance, you need to understand the interest rate you’re paying and whether there are any prepayment penalties associated with paying off the loan early. A prepayment penalty is a fee your lender charges if you pay off your loan before the agreed-upon term. These penalties can eat into your profits when you sell your car.

Let’s say you owe $10,000 on your car loan, and your lender charges a 2% prepayment penalty. That means you’ll need an additional $200 to pay off the loan, so ensure you factor that into the pricing of the car.

Your Options for Selling a Car With a Financed Loan in Rancho Cucamonga

There are several avenues you can pursue when trying to sell a car with financed loan in Rancho Cucamonga. The best approach depends on your individual circumstances, financial situation, and how quickly you need to sell the vehicle. It’s crucial to carefully weigh the pros and cons of each option before making a decision. Let’s examine them closer.

The first, and often simplest, is paying off the loan before initiating the sale. This provides a clean title, making the transaction much smoother for both you and the buyer. Once the loan is satisfied, you can obtain the title from your lender (which could involve a trip to the Rancho Cucamonga DMV) and transfer it to the new owner.

However, this method requires you to have sufficient funds available to cover the outstanding loan balance. This option provides the most control but demands immediate capital.

Another popular choice is trading in your car at a local dealership. Dealerships such as John Elway’s Crown Toyota or Mercedes-Benz of Ontario routinely handle trade-ins involving financed vehicles. They will assess your car’s value, pay off your existing loan, and apply any remaining equity towards the purchase of a new car.

This is a convenient option, as the dealership takes care of most of the paperwork. However, be prepared to negotiate the trade-in value, as dealerships may offer less than you could potentially get from a private sale.

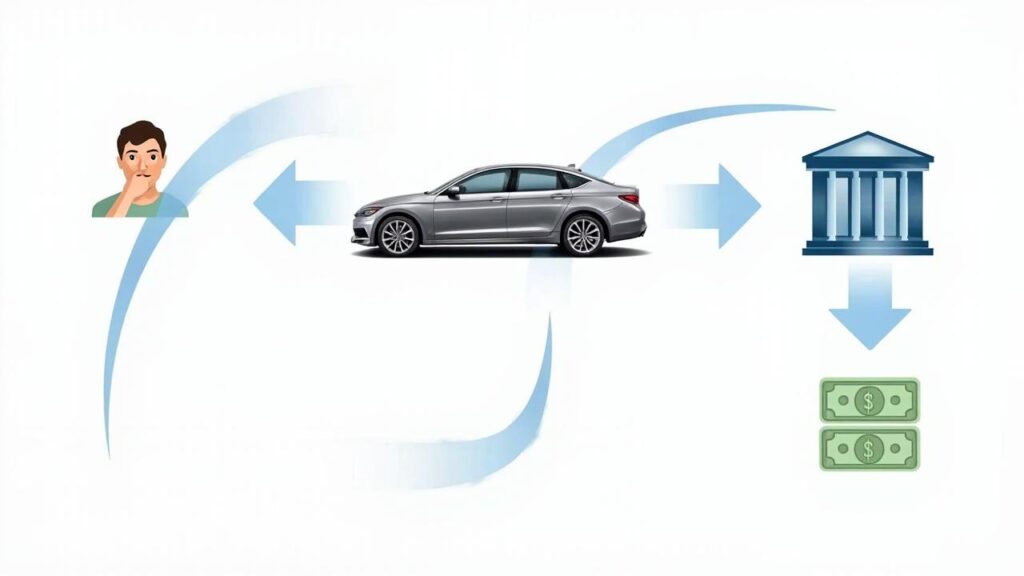

Finally, you can sell your car privately while still owing money on it. This method often yields a higher sale price but requires transparency and careful planning. It’s essential to disclose the existing loan to potential buyers upfront. You might need to arrange to meet the buyer at your lender’s location to facilitate the transaction.

The buyer pays the lender directly to satisfy the loan, and the lender then releases the title to the buyer. Alternatively, you could use an escrow service to ensure a secure transaction, especially for higher-value vehicles. This option necessitates meticulous documentation and communication.

| Selling Option | Pros | Cons |

|---|---|---|

| Pay Off Loan First | Clean title, simple transaction. | Requires upfront capital. |

| Trade-In at Dealership | Convenient, dealership handles paperwork. | Potentially lower value than private sale. |

| Private Sale with Loan | Potential for higher sale price. | Requires transparency and careful planning. |

Pricing Your Car Right for the Rancho Cucamonga Market

Pricing your car strategically is crucial for a successful sale in Rancho Cucamonga’s competitive market. You don’t want to leave money on the table, but you also don’t want to price your car so high that it sits unsold for weeks. A balanced approach, grounded in thorough research and an understanding of local trends, will help you find the sweet spot.

Determining Fair Market Value

Start by consulting reputable online valuation tools like Kelley Blue Book (KBB), Edmunds, and NADAguides. Input your car’s year, make, model, mileage, and condition. *Crucially*, make sure to use Rancho Cucamonga zip codes (91730, 91737, 91739) when prompted. Location matters. Car prices can vary significantly even within the Inland Empire due to local demand and economic factors. These tools will provide a range of estimated values, giving you a solid baseline.

Considering Key Factors

Several factors beyond the standard inputs influence your car’s value. Mileage is a big one; the lower the mileage, the higher the potential price. Condition is also paramount. Assess your car’s interior, exterior, and mechanical condition honestly. Are there any dents, scratches, or stains? Does everything function correctly?

Accident history is another critical consideration. A car with a clean title will command a higher price than one with a history of accidents. Finally, features can add value. Does your car have an upgraded sound system, leather seats, or a navigation system? These extras can make your car more attractive to buyers. If you plan to sell car with financed loan, accurately reflect all of these considerations.

Comparing to Local Listings

Once you have a sense of your car’s fair market value, take a look at what similar vehicles are selling for in Rancho Cucamonga. Browse online marketplaces like Craigslist, Facebook Marketplace, and AutoTrader, focusing on listings within a 25-50 mile radius. Pay attention to the asking prices of cars that are the same year, make, model, and trim level as yours, with similar mileage and condition.

This will give you a real-world perspective on what buyers are willing to pay in the local market. This comparison is a critical step in the pricing process. If you find that comparable cars are priced lower than your initial estimate, you may need to adjust your expectations accordingly.

Preparing Your Car for Sale

To get your car ready to impress buyers in Rancho Cucamonga, a meticulous cleaning is paramount. Think of it this way: a sparkling clean car suggests you’ve taken good care of it.

Don’t overlook minor repairs. While you don’t need to overhaul the engine, addressing small issues can significantly boost buyer confidence. Something as simple as replacing burned-out light bulbs or fixing a cracked windshield can make a positive impression. For instance, if the check engine light is on, getting it diagnosed and repaired shows you’re proactive. If you are going to *sell car with financed loan*, these details make the car much more appealing to buyers.

Finally, gather all essential paperwork. This demonstrates transparency and preparedness. Have the following readily available:

Highlight any key features that make your car stand out. Does it have excellent fuel efficiency, advanced safety features, or an upgraded sound system? Showcase these advantages in your advertising and during showings. By presenting your car in its best light, you increase your chances of a successful and profitable sale in the Rancho Cucamonga market.

Advertising Your Car in Rancho Cucamonga

To effectively reach potential buyers in the Rancho Cucamonga area, a multi-faceted advertising approach is crucial. Relying solely on one platform can limit your reach and potentially delay the sale of your vehicle. Consider a combination of online marketplaces, local classifieds, and visually appealing advertisements to maximize your chances of finding the right buyer at the right price.

Leveraging Online Marketplaces

Online marketplaces offer unparalleled reach, allowing you to connect with a vast audience actively searching for vehicles. Platforms like Craigslist, Facebook Marketplace, OfferUp, and AutoTrader are popular choices for Rancho Cucamonga residents. When listing your car, be sure to include detailed information about the vehicle, such as its year, make, model, mileage, condition, and features. High-quality photos are essential, as they provide potential buyers with a visual representation of the car’s condition.

Be honest and upfront about any flaws or issues with the vehicle, as transparency builds trust and can prevent potential disputes down the road. Consider investing in professional car detailing services beforehand to ensure your car looks its best in the photos. When trying to sell car with financed loan, it is beneficial to take photos of all appropriate documents, such as service and maintenance reports.

Harnessing the Power of Local Classifieds

While online marketplaces are valuable, don’t overlook the potential of local classifieds. Check for any relevant local publications or websites that cater specifically to the Rancho Cucamonga community. These platforms can help you target buyers who are actively looking for vehicles within the area.

When creating your classified ad, focus on highlighting the key selling points of your car and emphasize its relevance to local residents. For example, if you’re selling an SUV, you could mention its suitability for exploring the nearby mountains and trails. Consider localizing your ad by using familiar landmarks or mentioning specific neighborhoods in Rancho Cucamonga.

Crafting Compelling Advertisements

Regardless of the platform you choose, the quality of your advertisement will significantly impact its effectiveness. Invest time in crafting a compelling description that highlights the key selling points of your car. Be specific and detailed, mentioning any upgrades, features, or recent maintenance work. Use persuasive language to entice potential buyers, but avoid making false or misleading claims.

Honesty is essential for building trust and avoiding legal issues. Take high-quality photos that showcase the car’s best features, ensuring they are well-lit and clear. Consider taking photos from various angles to provide a comprehensive view of the vehicle. Also, provide all relevant information in your advertisement that a buyer would need to sell car with financed loan.

Safety First: Meeting Potential Buyers

When meeting potential buyers, safety should always be your top priority. Choose a public place for the meeting, such as the parking lot of a local shopping center like Victoria Gardens or a well-lit area near a police station. Bring a friend or family member with you for added security.

Be wary of scams and avoid providing personal information or accepting suspicious forms of payment. Trust your instincts, and if anything feels off, don’t hesitate to walk away from the deal.

Navigating the Legal Aspects of Selling a Financed Car in California

California law requires full disclosure when selling a vehicle, and this is especially crucial when you still have a loan. You’re legally obligated to inform any potential buyer that there’s a lien on the title. Failure to do so could lead to legal trouble down the road. Make sure this disclosure is clearly stated in any advertisement you create and reiterated during discussions with potential buyers. Transparency builds trust and helps avoid future complications.

When transferring ownership, the California Department of Motor Vehicles (DMV) has specific requirements. You’ll need a bill of sale, which should include the purchase price, date of sale, and names and addresses of both the buyer and seller. The title transfer form (REG 227) must be completed and submitted to the DMV. A smog certification is typically required unless the vehicle is exempt (e.g.

newer models). These documents ensure a legal and valid transfer of ownership, protecting both you and the buyer. The process to *sell car with financed loan* is always easier when you dot your I’s and cross your T’s.

Unfortunately, car selling scams are prevalent. Be wary of buyers offering significantly more than the asking price or those who insist on using unusual payment methods. Always meet in a public place and avoid sharing personal information beyond what’s necessary for the transaction.

If anything feels off, trust your instincts and consider walking away. For complex loan situations or potential disputes, consulting with a legal professional is always a wise decision. They can provide guidance tailored to your specific circumstances and ensure that your rights are protected.

| Document | Description | Purpose |

|---|---|---|

| Bill of Sale | Document outlining sale details (price, date, parties involved) | Legal record of the transaction |

| Title Transfer Form (REG 227) | Form required by the California DMV to transfer ownership | Official transfer of vehicle ownership |

| Smog Certification | Proof that the vehicle passed a smog test (unless exempt) | Required for vehicle registration in California |

Conclusion

Selling a car that still has a loan attached to it can initially seem daunting, but with the right information and preparation, it’s entirely achievable for Rancho Cucamonga residents. The key is to approach the process methodically, understanding your financial obligations and exploring the various avenues available to you.

Whether you decide to pay off the loan before selling, trade it in at a local dealership, or work with a private buyer, being informed and proactive is crucial for a smooth transaction.

Remember, the first step is always to determine your loan balance and any associated fees. Once you have a clear understanding of your financial situation, you can then evaluate the different options for selling. Consider the pros and cons of each approach, factoring in your personal circumstances and preferences.

For instance, if you need to sell car with financed loan quickly and without hassle, trading it in at a dealership might be the best choice. However, if you’re looking to maximize your return, selling to a private buyer could be more lucrative, although it requires more time and effort.

Regardless of the method you choose, transparency and honesty are paramount. Be upfront with potential buyers about the loan and provide them with all the necessary information. This will not only build trust but also help ensure a successful and legally sound transaction. By following these guidelines and taking the time to do your research, you can navigate the process of selling a financed car in Rancho Cucamonga with confidence and achieve your desired outcome.

Resources

Selling a car with a loan in Rancho Cucamonga might initially seem daunting, but as we’ve explored, it’s a very achievable goal. Remember that the most important first step is understanding your loan details – knowing your outstanding balance, interest rate, and any potential prepayment penalties is crucial for making informed decisions.

From there, carefully evaluate your options, whether it’s paying off the loan before selling, trading it in at a reputable local dealership, engaging with a private buyer, or exploring offers from online car buyers.

Each method has its own set of advantages and disadvantages, and the best choice for you will depend on your individual circumstances and financial situation. For example, if you’re looking for the simplest solution, trading in your vehicle might be the way to go, especially since dealerships like John Elway’s Crown Toyota and Mercedes-Benz of Ontario are equipped to handle the complexities of paying off your existing loan.

On the other hand, if you are considering a private sale, remember that transparency is key.

Disclose the existing loan to potential buyers upfront and consider meeting them at your lender to facilitate a secure and transparent transaction. If you’re looking for convenience, you might consider selling to an online car buyer. You can *sell car with financed loan* to these types of companies but due diligence is still critical.

Ultimately, armed with the knowledge from this guide, you can confidently navigate the process of selling your car in Rancho Cucamonga, even with an outstanding loan. Take your time, do your research, and don’t hesitate to seek professional advice if needed. With careful planning and execution, you can successfully sell your car and move on to your next automotive adventure.

Now that you’re equipped with this guide, start by checking your loan balance, assessing your car’s market value, and then move forward with the selling strategy that best fits your needs. Best of luck.

Frequently Asked Questions

Can I sell a car that I still have a loan on?

Yes, you can sell a car even if you still have an outstanding loan on it. However, the process is a bit more complex than selling a car you own outright.

The key is that the loan needs to be satisfied during the sale, meaning the lender must be paid off in full before the title can be transferred to the new owner.

What happens to my car loan when I sell the car?

When you sell a car with an outstanding loan, the loan doesn’t simply disappear. The proceeds from the sale must first be used to pay off the remaining balance of the loan.

Any money left over after paying off the loan is yours. If the sale price is less than the loan balance, you’ll need to cover the difference, which is sometimes referred to as being “upside down” on the loan.

How do I find out my loan payoff amount before selling my financed car?

Finding out your loan payoff amount is a straightforward process. Contact your lender directly, whether it’s a bank, credit union, or finance company. You can usually find their contact information on your loan statement or online.

Request a payoff quote, specifying the exact date you plan to sell the car, as interest accrues daily. This quote will include the principal balance, accrued interest, and any applicable fees.

What are the steps involved in selling a car with an outstanding loan?

Selling a car with an outstanding loan involves several steps. First, determine your loan payoff amount. Next, find a buyer for your car, agreeing on a sale price.

Then, coordinate with the buyer and your lender to ensure the loan is paid off. This might involve the buyer paying the lender directly or you using the sale proceeds to pay off the loan. Once the loan is satisfied, the lender will release the title, which you can then transfer to the buyer.

Can I trade in a car that I still owe money on?

Yes, you can absolutely trade in a car even if you still owe money on it. In fact, it’s a very common practice. The dealership will assess the value of your trade-in and determine the remaining balance on your loan.

If your car’s trade-in value is greater than the loan balance, the dealership will apply the excess as a credit toward your new car purchase. If the loan balance is higher than the trade-in value, the difference will be added to the loan amount for your new vehicle, creating a new, larger loan.